Why You Need To Keep Track Of Your Credit Score

First-time credit union members may have questions about joining. One of the most prevalent queries is if credit unions monitor your credit score.

The answer is yes, credit unions do check credit when you join. However, there’s no need to worry. Your score won’t necessarily determine membership. But, it may determine your eligibility for certain services. Your credit history and score will also be considered when deciding whether to grant you a credit card or auto loan when you submit your credit union membership application.

It would be futile to encourage you to raise your credit score, but before we can do so, we need to know what your credit score is.

What Is Credit?

Credit reports and scores are two separate things, but they are connected. A person’s credit score is determined by the details included in their credit report.

Generally speaking, your credit score reflects how responsibly you handle debt. There’s an algorithm that uses your personal information to assign you a three-digit number that indicates whether you’d be a good candidate for a loan. You’ll be seen as less of a danger to lenders if your score is high, and as such, you’ll be more likely to get higher loans.

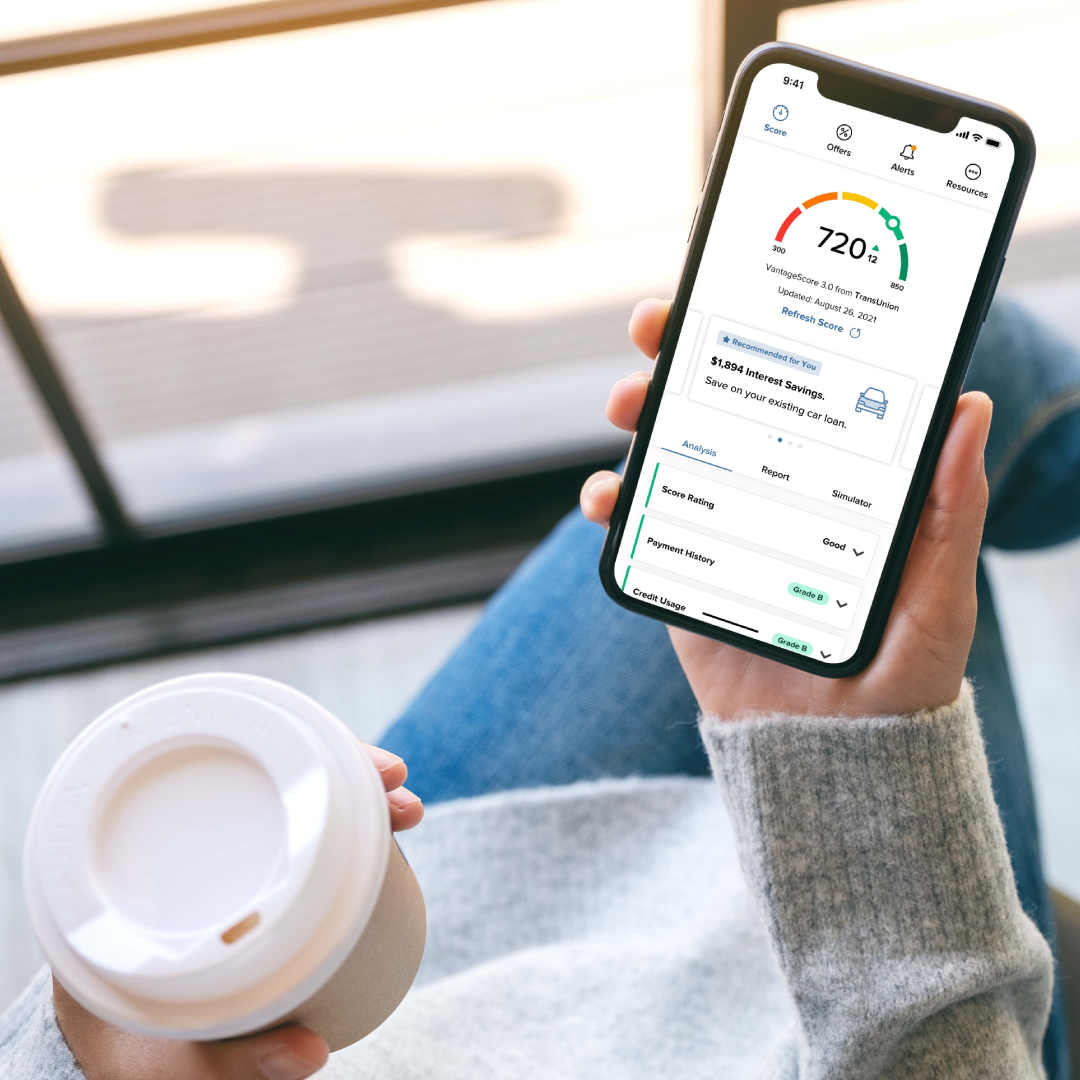

Many factors go into determining your credit score, including but not limited to: on-time payments, total debt, account age, credit mix, and recent credit inquiries. Usually, it fluctuates around between 300 and 850.

Lenders learn everything they need to about your credit history by looking at your credit report. Typically, a credit report from one of the three major credit reporting agencies will include the following sections: personal information, account information/trade lines, public records, and inquiries. Your credit report inquiry can be either a hard pull or a soft pull, depending on the nature of the inquiry.

When a lender conducts a hard pull, they are seriously considering your credit application. Your credit score may be negatively impacted by a hard inquiry, depending on your individual circumstances. Instead of using the credit check results to determine whether to lend money, a soft pull might be performed as part of a routine background investigation. Soft pulls do not impact credit scores.

Why you should monitor your credit

If you want to know how healthy your finances are as a whole, look no further than your credit score. Ignoring your credit score could have serious consequences on your finances. It’s better to know your credit score, good or bad, than to have no idea at all. Even if your score is poor, there are things you can do to improve it. The alternative is to work on keeping a good credit score if you already have one.

You can’t just prepare your credit score a few days before you need it. Even if you have a poor score, there are things you can do to improve it. Instead, establishing a positive credit history takes time — sometimes months or even years. You can take charge of your credit and increase your sense of personal accountability by checking your credit report regularly.

As a full-service, non-profit financial cooperative, CVF Credit Union’s mission is to assist the Catholic community. In the 29 communities we serve across the lower peninsula of Michigan, we are dedicated to bringing the credit union philosophy of “people helping people” to life by utilizing cutting-edge technology, competitive rates, low fees, and individualized service.