$1,200 for coffee? Who does that?

It’s 6:45 AM on a Tuesday in December. It’s twelve degrees outside, and you can see the snow starting to fall gently on the once green grass. You get into your car and crank the heat up as you’re driving to school. On the way to school, you stop by Starbucks and decide to treat yourself to a venti caramel macchiato.

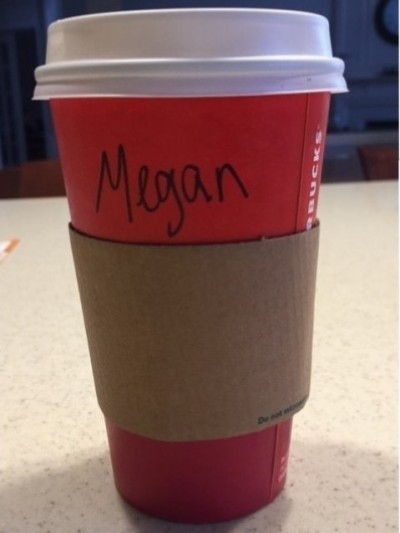

The taste of hot coffee is heavenly this early in the morning, and your red cup with your name messily scrawled on by the barista is slowly starting to warm your hands as you are walking to first period. This scenario seems innocent. It’s just coffee, right?

Although a simple Starbucks run on the way to school may seem innocent, it has a pricy consequence in the long run. That venti caramel macchiato you bought this morning cost $4.65. Treating yourself to a coffee here and there is one thing, but making it a routine is a different story. What happens when that caramel macchiato becomes part of your morning routine?

If you bought that venti caramel macchiato on the way to school everyday for a year, you would spend roughly $1,200 on coffee.

If you have a job that pays minimum wage, you would have to work close to two hundred hours to afford your coffee! Is working two hundred hours really worth two hundred sixty trips to Starbucks?

Five dollars here and there will not hurt your savings account, but if you continue to spend five dollars on coffee everyday, your savings account will be a sad story by the end of the year. This isn’t to say that you can’t enjoy Starbucks; surely, treat yourself to coffee from time to time.

The point here is that a seemingly harmless purchase such as coffee has a grandiose total at the end of the year. I don’t know about you, but I certainly don’t know too many high school seniors that have $1,200 to spare.

Before you instinctively make your morning trek to Starbucks, ask yourself: is it really worth it in the long run?